AML & Fraud Detection

Objective

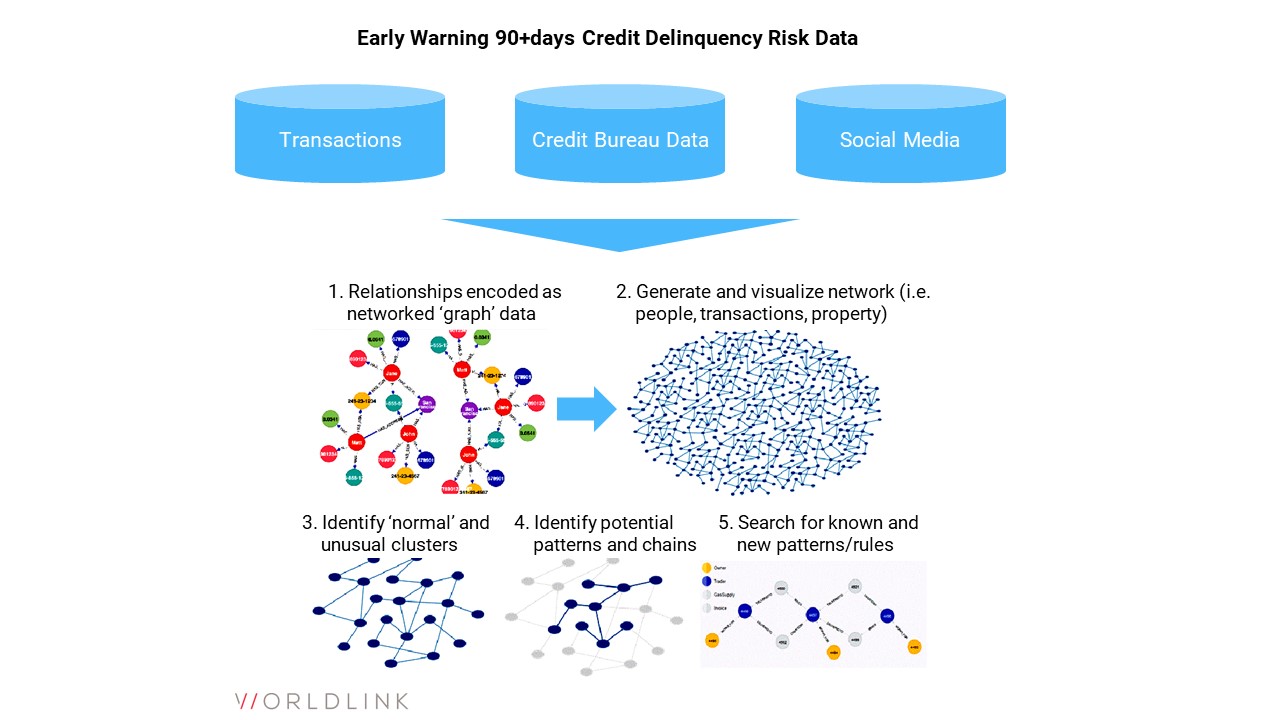

Complement traditional AML and fraud analytics with social network analysis. Uncover nuanced time-evolving connections between entities to surface suspicious activities for review or feedback.

Industry: Financial Services – Banking

Services: Technology Innovation

Technology: Social Network Analysis

8%

previously unidentified (new) relationships that held promise were identified vs. manual review method

Overlap of

75%+

with the client’s traditional (time consuming) AML and fraud ring detection process

Together made a strong case for process automation under the guidance of AML and Fraud analysts to reinforce the algorithm’s learning of undetected patterns

Our Client

Our client is a regional financial institution who provides a comprehensive suite of banking services tailored to businesses, individuals, and wealth management clients. With a focus on personalized solutions and local expertise, it offers commercial banking, private banking, and treasury management services.

Challenge

Financial institutions lose several millions of dollars in revenue to systematic fraud. Emergence of new technologies and payment forms, aside from an increasingly global turn on identify-theft, money laundering and security, pose new challenges.

Approach

Cross-linked various data assets across time to surface a social network of suspicious activities

- Enterprise Transactions

- Credit Bureau & Social Media

Outcomes

- 80/20 workload rebalance for AML & fraud analysts – as they now focus their attention on training the social network to recognize undetected cases

- Reactive complementary analysis requiring timely refreshes to stay on top of evolving AML/fraud dynamics

Impact

- 75%+ overlap with the client’s traditional (time consuming) AML and fraud ring detection process

- 8% previously unidentified (new) relationships that held promise were identified vs. manual review method

- Together made a strong case for process automation under the guidance of AML and Fraud analysts to reinforce the algorithm’s learning of undetected patterns

View more Case Studies

Issues (Risk) Correlation & Consolidation Analysis

Hybrid Cloud Analytics

Data Strategy Implementation

Ready to transform your business?

Explore Our Services and Unleash Your Potential Today!