Customer Intelligence

Objective

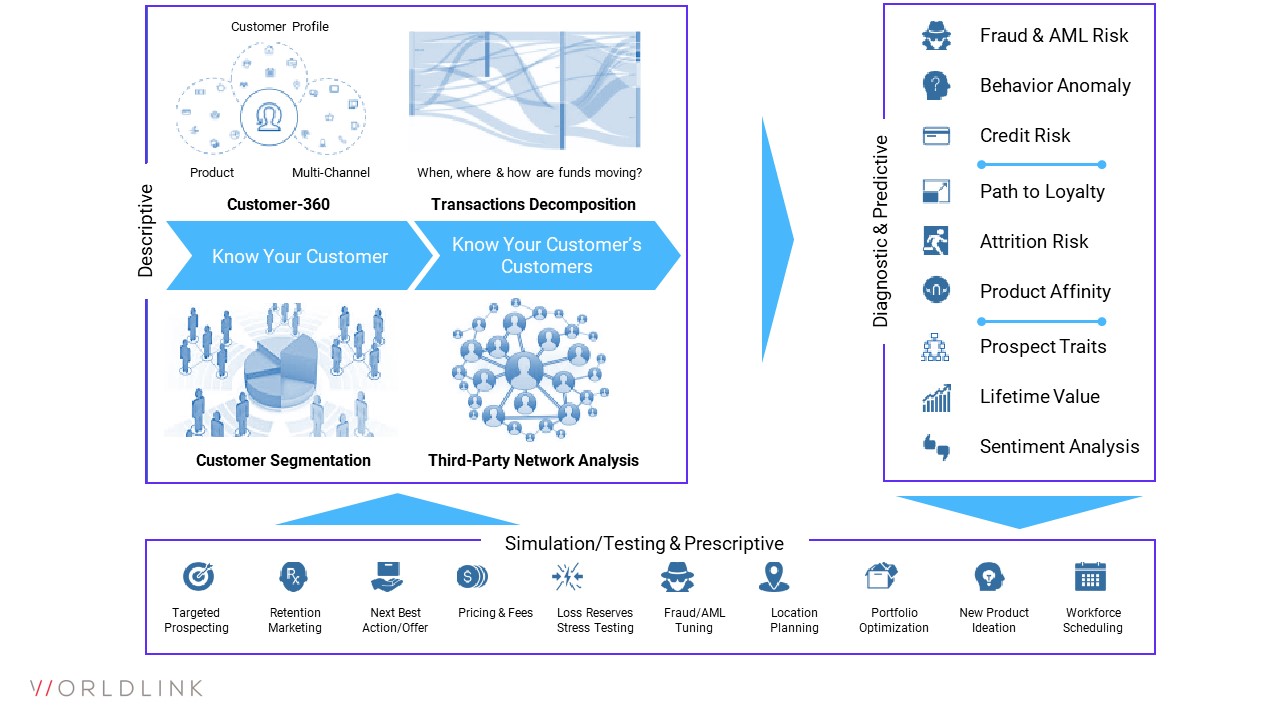

Provide customer intelligence to assist the bank’s objectives of increasing market share through x/up-sell, targeted prospecting and driving customer value and growth

Industry: Commercial Banking

Services: Transformation Enablement

Technology: Unsupervised Learning

Revenue increase of

15%

through enhanced customer insight

Our Client

Our client is a regional financial institution who provides a comprehensive suite of banking services tailored to businesses, individuals, and wealth management clients. With a focus on personalized solutions and local expertise, it offers commercial banking, private banking, and treasury management services.

Challenge

Parallel to their enterprise initiatives to upgrade infrastructure and core banking apps, they are also seeking to operationalize customer intelligence insights that will kickoff their ML journey

Approach

Unsupervised learning against seven years of client’s commercial customers’ transactional data

- Direction (debit vs. credit), Product Channel (Wires/ACH, Deposits, Loans, Wealth) and

- Category (payroll vs. business supplies vs. entertainment, etc.)

Outcomes

Enable Relationship Managers to prioritize customer portfolio for various initiatives from customer value growth, to identifying customer attrition risk and increasing share of customers’ wallets

Anticipating a higher cadence of interactions with customers based on the trends identified from the transaction’s analysis

Impact

12% – 15% revenue growth potential from improved visibility into customers’ evolving needs and ability to address these on a higher cadence throughout the year

View more Case Studies

Empowering Operational Efficiency With GenAI

Issues (Risk) Correlation & Consolidation Analysis

Hybrid Cloud Analytics

Ready to transform your business?

Explore Our Services and Unleash Your Potential Today!